- About Green Delta Dragon

- Mission

- Vision

- Aspiration

Green Delta Dragon is a joint-venture asset manager founded by Green Delta Insurance Company Ltd (GDIC), Dragon Capital Management (HK) Ltd. (Dragon Capital) and Equinox Dhaka Ltd. (Equinox). Green Delta Insurance Company is the largest general insurance company in Bangladesh, providing protection over BDT 3.5 trillion (US$ 32.4 bln.) of insured assets, while the Dragon Capital Group is the largest and longest established asset management group in Vietnam with assets under management (AUM) in the country of over US$ 5 bln., and Equinox, an emerging market investment advisory firm, contributes knowledge of some of Bangladesh’s most dynamic finance professionals.

Green Delta Dragon was awarded Asset Management License from the Bangladesh Securities and Exchange Commission (BSEC) on 24 November 2021.

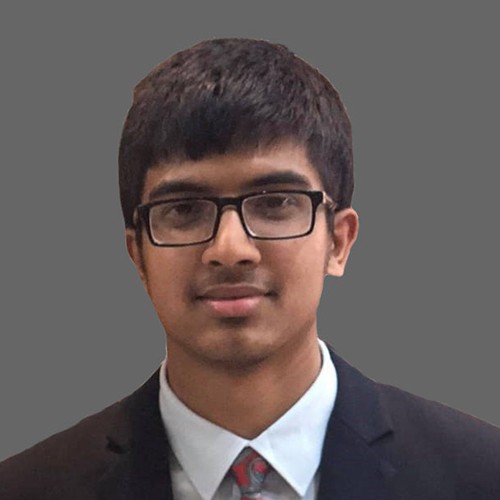

From our offices on the 3rd Floor of Green Delta AIMS Tower, Green Delta Dragon seeks to add value to traditional products by offering unique investment variations, as well as to provide innovative new products, to reward engaged customers through portfolio diversification. As a research-led asset manager, Green Delta Dragon has painstakingly composed an experienced, senior research team focused on the economy of Bangladesh and the sustainable growth potential of its investees within it. Green Delta Dragon utilizes its exclusive investment criteria, global and local knowledge & expertise to optimize investment decision-making, adhering to the simple concept that if you do your homework, you’ll achieve the best result!

And with deep roots in the international asset management industry, Green Delta Dragon recognizes that the best results supersede return only. Environmental, social and governance (ESG) issues can influence investment risk and portfolio performance. We believe that taking a strategic, long-term approach to responsible investing will create lasting value for Green Delta Dragon, our stakeholders and the wider community. For this reason, Green Delta Dragon integrates ESG factors into its proprietary investment criteria and applies such criteria to all its investment products and services.

Company profile of GDDA

Here you can download broachers, fact sheets and other materials that provide an overview of the investment strategies and performance of GDD’s portfolios.

Whether you are a current or potential investor, these resources can help you make informed decisions about your investments and stay up-to-date on the latest developments at Green Delta Dragon

Company profile of GDDA

Here you can download broachers, fact sheets and other materials that provide an overview of the investment strategies and performance of GDD’s portfolios.

Whether you are a current or potential investor, these resources can help you make informed decisions about your investments and stay up-to-date on the latest developments at Green Delta Dragon

To be a top-class intermediator of capital in Bangladesh by providing attractive returns to investors, value to companies, and a desirable workplace for employees and to perform with absolute professionalism and integrity, driven by long-term commitment to the environment, society and economy of Bangladesh.

To combine the unique local know-how, relationships and insights of the Green Delta Insurance Group with the asset management experience and international best practices of the Dragon Capital Group, and to follow an investment approach driven by close teamwork, rigorous research and the latest financial technology to deliver superior products and services to investors.

Outperform the benchmark over medium to long term, ensuring superior growth in terms of return and reliance .