Green Delta Dragon Enhanced Blue Chip Growth Fund (GDD EBCGF) is an unlisted, open-end mutual fund with a perpetual life. Institutional and individual investors, residing both in and outside of Bangladesh, including NRBs and foreign nationals, are eligible to invest in GDD EBCGF.

The initial target size of GDD EBCGF is BDT 500,000,000- (Bangladesh Taka five hundred million), divided into 50,000,000 (fifty million) units of BDT 10- (Bangladesh Taka ten) each. The size of GDD EBCGF shall be increased from time to time by the asset manager subject to approval of the trustee and with due intimation with the BSEC.

SPONSORS, MANAGER AND ADMINISTRATORS

| Fund Name : | Green Delta Dragon Enhanced Blue Chip Growth Fund |

| Type/ Nature : | Unlisted, open-end mutual fund |

| Life and Size of GDD EBCGF : | Perpetual life and unlimited size |

| Sponsors : | Green Delta Insurance Company Limited and Dragon Capital Markets Limited |

| Asset Manager : | Green Delta Dragon Asset Management Company Limited |

| Trustee : | Bangladesh General Insurance Company Limited |

| Custodian : | BRAC Bank Limited |

| Initial Target Size : | BDT 500,000,000- (Bangladesh Taka five hundred million) divided into 50,000,000 (fifty million) units of BDT 10- (Bangladesh Taka ten) each |

| Face Value : | BDT 10 (Bangladesh Taka ten) per Unit |

| Investment Objective : | The investment objective of GDD EBCGF is to outperform the benchmark DS30 index return rate on an annual basis to the extent reasonably possible by focusing on select investments in the securities of market leading companies, targeting capitalizations of BDT 8,500,000,000- (Bangladesh Taka eight billion five hundred million) or more and IPO investments of potential future market leaders. |

| The Green Delta Dragon Enhanced Blue Chip Growth Fund, Green Delta Dragon Asset Management Company Limited, Green Delta Insurance Company Limited and Dragon Capital Markets Limited in no way guarantee the performance of GDD EBCGF or the preservation of capital invested into it by investors. | |

| Minimum Application Lot : | Minimum application unit lot during subscription: |

| 500 (five hundred) units per application for individuals (BDT 5,000 (Bangladesh Taka five thousand) @ BDT 10- (Bangladesh Taka ten) each) | |

| 5,000 (five thousand) units per application for institutions (BDT 50,000 (Bangladesh Taka fifty thousand) @ BDT 10- (Bangladesh Taka ten) each) | |

| Subscription : | Subscribers during the initial subscription period of GDD EBCGF will be issued acknowledgement certificates for the amount of subscription funds received by GDD EBCGF and, upon the conclusion of the initial subscription period, will receive a confirmation of unit allocation and be issued unit certificates in minimum marketable lots, as determined by the asset manager on behalf of GDD EBCGF, at face value of BDT 10- (Bangladesh Taka ten). |

| Ongoing Purchases and Sales : | After the close of the initial subscription period, GDD EBCGF units may be purchased by investors and sold by unit holders during the ongoing offer period in minimum lots of 500 (five hundred) Units for individuals and 5,000 (five thousand) units for institutional investors, and SIP investors may purchase unit certificates in minimum amount of BDT 1,000 (Bangladesh Taka one thousand) and sell unit certificates as directed in the SIP brochure. |

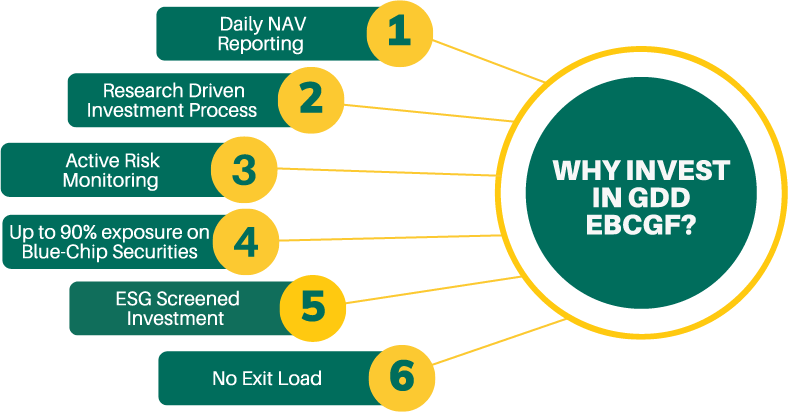

| NAV of the Fund : | The NAV of GDD EBCGF will be calculated by GDDA on behalf of the Fund at the close of business hours on each trading day or as directed by the BSEC with adequate disclosure. |

| Offer and Bid Prices : | The Asset Manager, on behalf of GDD EBCGF, will calculate GDD EBCGF’s sale price (investor purchase price) per Unit (Offer Price) and repurchase price (unit holder sale price) per unit (Bid Price) at the beginning of each new trading day, with the Offer Price being the NAV per Unit at fair value as calculated per clause 3.8 of this Prospectus at the close of Business Hours on the preceding trading day. GDD EBCGF Offer Price and Bid Prices shall be published on the website of the Fund (www.greendeltadragon.com/EBCGF), GDDA and through authorized Selling Agents as prescribed in the Rules. |

| Investors : | Individuals – people residing both in and outside of Bangladesh, including NRBs and foreign nationals. |

| Institutions, both domestic and foreign companies, financial institutions, non-bank financial institutions, mutual funds and collective investment schemes, as prescribed in the Rules. | |

| Dividend Policy : | GDD EBCGF shall distribute a minimum of 50% (fifty percent) of its annual realized net profit as Dividend at the end of each accounting year after making provision for diminution in the value of its financial assets and any dividend equalization reserve. GDD EBCGF may also create a dividend equalization reserve by appropriation from its income subject to compliance with the Rules. |

| Dividends shall never be paid out of other comprehensive income and/or unrealized capital gains. | |

| The default payment option to Unit Holders for GDD EBCGF dividends shall be cash. If a unit holder wishes to reinvest its dividend using cumulative investment plan (CIP), it may apply to the Asset Manager to do so within 15 (fifteen) days of the dividend declaration date. The calculation for the conversion of dividend distributions to GDD EBCGF units shall divide the unit holder cash dividend entitlement by the GDD EBCGF NAV per unit calculated at the close of business hours on the record date. A calculation resulting in partial units of 0.50 (zero point five) or above shall be rounded up to a whole, while a calculation resulting in partial units of less than 0.50 (zero point five) shall be rounded down to a whole. Unit holders should consult their tax advisor with regard to the tax treatment of GDD EBCGF cash dividend and reinvestment under CIP. | |

| Dividends shall be paid by GDD EBCGF within 45 (forty-five) days from the declaration of such dividends. | |

| Potential Tax Benefits : | Include: a) Dividends of up to BDT 25,000- (Bangladesh Taka twenty-five thousand) per annum received from a mutual fund are presently exempt from tax in Bangladesh under the Income Tax Ordinance 1984. b) Investment in a mutual fund may qualify for investment tax credit in Bangladesh under section 44(2) of the Income Tax Ordinance 1984. c) Income received by mutual funds, including GDD EBCGF, is presently exempt from corporate income tax. |

| If a unit holder is a non-resident, such unit holder may qualify for a tax exemption, subject to the double taxation avoidance convention between the Government of Bangladesh and the government of the country of residence of the Unit Holder, if any. | |

| The Income Tax Ordinance 1984 of Bangladesh is subject to change in accordance with the Finance Act of Bangladesh and none of Green Delta Dragon Enhanced Blue Chip Growth Fund, Green Delta Dragon Asset Management Company Limited, Green Delta Insurance Company Limited and Dragon Capital Markets Limited make any representation as to the applicability of the abovementioned potential tax benefits to investors in the GDD EBCGF. | |

| Encashment : | Unit holders may sell units of GDD EBCGF to the asset manager in accordance with the Unit selling procedures of the Fund. |

| Exit Load : | Other than potential exit load associated with SIP investing, GDD EBCGF bears no exit load. |

| Transferability : | The units of GDD EBCGF are transferable by way of inheritance/gift and/or by specific operation of the law of the Government of Bangladesh. |

| Prospectus, Reports, and Accounts : | This Prospectus is available on the website of the Fund (www.greendeltadragon.com/EBCGF). Every Unit Holder is entitled to receive quarterly portfolio statements, semi-annual and annual statements of account and an annual report of GDD EBCGF as and when published on the website of the Fund (www.greendeltadragon.com/EBCGF) and that of the asset manager (www.greendeltadragon.com). |

| Systematic Investment Plan (SIP) : | Systematic investment plan or SIP allows an investor to invest a certain pre-determined amount of BDT into GDD EBCGF at regular intervals (i.e. monthly.). A SIP is a planned approach towards investment that promotes saving habits. |

| Cumulative Investment Plan (CIP) : | Cumulative investment plan or CIP allows an investor to reinvest dividend distributions of GDD EBCGF. |

Fund Performance

Calendar Year Total Returns

Average Annual Total Returns

Portfolio

Asset Allocation

Sector Allocation

| Top 10 Holdings | Weight | |||

| BATBC | 7% | |||

| OLYMPIC | 6% | |||

| BRACBANK | 8% | |||

| MERCANTILEBANK | 9% | |||

| SAOPORT | 8% | |||

| SQUREPHARMA | 6% | |||

| SQURETEXTILE | 8% | |||

| MARICO | 9% | |||

| RENATA | 9% | |||

Historical NAV

| DATE | FUND NAME | NAV (MARKET PRICE) | SELL | REPURCHASE |

|---|---|---|---|---|

| 25/07/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.45 | 10.45 | 10.45 |

| 24/07/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.44 | 10.44 | 10.44 |

| 18/07/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.47 | 10.47 | 10.47 |

| 16/07/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.46 | 10.46 | 10.46 |

| 15/07/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.44 | 10.44 | 10.44 |

| 14/07/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.44 | 10.44 | 10.44 |

| 11/07/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.44 | 10.44 | 10.44 |

| 10/07/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.46 | 10.46 | 10.46 |

| 09/07/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.45 | 10.45 | 10.45 |

| 08/07/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.45 | 10.45 | 10.45 |

| 07/07/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.45 | 10.45 | 10.45 |

| 04/07/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.43 | 10.43 | 10.43 |

| 03/07/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.4 | 10.4 | 10.4 |

| 02/07/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.4 | 10.4 | 10.4 |

| 30/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.4 | 10.4 | 10.4 |

| 27/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.41 | 10.41 | 10.41 |

| 26/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.39 | 10.39 | 10.39 |

| 25/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.37 | 10.37 | 10.37 |

| 24/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.36 | 10.36 | 10.36 |

| 23/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.36 | 10.36 | 10.36 |

| 20/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.35 | 10.35 | 10.35 |

| 19/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.33 | 10.33 | 10.33 |

| 13/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 12/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.3 | 10.3 | 10.3 |

| 11/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.29 | 10.29 | 10.29 |

| 10/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.29 | 10.29 | 10.29 |

| 09/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 06/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.32 | 10.32 | 10.32 |

| 05/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.32 | 10.32 | 10.32 |

| 04/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 03/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 02/06/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 30/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 29/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 28/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 27/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.3 | 10.3 | 10.3 |

| 26/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.3 | 10.3 | 10.3 |

| 23/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.3 | 10.3 | 10.3 |

| 21/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 20/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.3 | 10.3 | 10.3 |

| 19/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.32 | 10.32 | 10.32 |

| 16/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.32 | 10.32 | 10.32 |

| 15/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.32 | 10.32 | 10.32 |

| 14/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.33 | 10.33 | 10.33 |

| 13/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.34 | 10.34 | 10.34 |

| 12/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.34 | 10.34 | 10.34 |

| 09/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.34 | 10.34 | 10.34 |

| 08/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.34 | 10.34 | 10.34 |

| 07/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.32 | 10.32 | 10.32 |

| 06/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.32 | 10.32 | 10.32 |

| 05/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.32 | 10.32 | 10.32 |

| 02/05/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 30/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 29/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 28/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 25/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.29 | 10.29 | 10.29 |

| 24/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 23/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 22/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.3 | 10.3 | 10.3 |

| 21/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 18/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.3 | 10.3 | 10.3 |

| 17/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 16/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 15/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 09/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 08/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.32 | 10.32 | 10.32 |

| 04/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 03/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 02/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 01/04/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.3 | 10.3 | 10.3 |

| 31/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.31 | 10.31 | 10.31 |

| 28/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.3 | 10.3 | 10.3 |

| 27/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.29 | 10.29 | 10.29 |

| 25/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.28 | 10.28 | 10.28 |

| 24/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.28 | 10.28 | 10.28 |

| 21/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.28 | 10.28 | 10.28 |

| 20/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.27 | 10.27 | 10.27 |

| 19/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.27 | 10.27 | 10.27 |

| 18/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.27 | 10.27 | 10.27 |

| 14/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.26 | 10.26 | 10.26 |

| 13/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.26 | 10.26 | 10.26 |

| 12/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.26 | 10.26 | 10.26 |

| 11/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.25 | 10.25 | 10.25 |

| 10/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.25 | 10.25 | 10.25 |

| 07/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.24 | 10.24 | 10.24 |

| 06/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.24 | 10.24 | 10.24 |

| 05/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.24 | 10.24 | 10.24 |

| 04/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.24 | 10.24 | 10.24 |

| 03/03/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.23 | 10.23 | 10.23 |

| 29/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.23 | 10.23 | 10.23 |

| 28/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.23 | 10.23 | 10.23 |

| 27/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.23 | 10.23 | 10.23 |

| 25/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.23 | 10.23 | 10.23 |

| 22/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.22 | 10.22 | 10.22 |

| 20/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.22 | 10.22 | 10.22 |

| 19/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.22 | 10.22 | 10.22 |

| 18/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.21 | 10.21 | 10.21 |

| 15/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.21 | 10.21 | 10.21 |

| 14/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.21 | 10.21 | 10.21 |

| 13/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.21 | 10.21 | 10.21 |

| 12/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.21 | 10.21 | 10.21 |

| 11/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.21 | 10.21 | 10.21 |

| 08/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.2 | 10.2 | 10.2 |

| 07/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.2 | 10.2 | 10.2 |

| 06/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.2 | 10.2 | 10.2 |

| 05/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.2 | 10.2 | 10.2 |

| 04/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.19 | 10.19 | 10.19 |

| 01/02/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.18 | 10.18 | 10.18 |

| 31/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.18 | 10.18 | 10.18 |

| 30/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.18 | 10.18 | 10.18 |

| 29/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.18 | 10.18 | 10.18 |

| 28/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.17 | 10.17 | 10.17 |

| 25/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.17 | 10.17 | 10.17 |

| 24/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.17 | 10.17 | 10.17 |

| 23/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.17 | 10.17 | 10.17 |

| 22/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.17 | 10.17 | 10.17 |

| 21/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.17 | 10.17 | 10.17 |

| 18/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.16 | 10.16 | 10.16 |

| 17/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.16 | 10.16 | 10.16 |

| 16/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.16 | 10.16 | 10.16 |

| 15/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.16 | 10.16 | 10.16 |

| 14/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.16 | 10.16 | 10.16 |

| 11/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.15 | 10.15 | 10.15 |

| 10/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.15 | 10.15 | 10.15 |

| 09/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.15 | 10.15 | 10.15 |

| 08/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.15 | 10.15 | 10.15 |

| 04/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.14 | 10.14 | 10.14 |

| 03/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.14 | 10.14 | 10.14 |

| 02/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.14 | 10.14 | 10.14 |

| 01/01/2024 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.14 | 10.14 | 10.14 |

| 28/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.12 | 10.12 | 10.12 |

| 27/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.12 | 10.12 | 10.12 |

| 26/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.12 | 10.12 | 10.12 |

| 24/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.12 | 10.12 | 10.12 |

| 21/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.11 | 10.11 | 10.11 |

| 20/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.11 | 10.11 | 10.11 |

| 19/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.11 | 10.11 | 10.11 |

| 18/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.11 | 10.11 | 10.11 |

| 17/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.11 | 10.11 | 10.11 |

| 14/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.1 | 10.1 | 10.1 |

| 13/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.1 | 10.1 | 10.1 |

| 12/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.1 | 10.1 | 10.1 |

| 11/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.1 | 10.1 | 10.1 |

| 10/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.09 | 10.09 | 10.09 |

| 07/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.09 | 10.09 | 10.09 |

| 06/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.09 | 10.09 | 10.09 |

| 05/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.09 | 10.09 | 10.09 |

| 04/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.09 | 10.09 | 10.09 |

| 03/12/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.08 | 10.08 | 10.08 |

| 30/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.08 | 10.08 | 10.08 |

| 29/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.08 | 10.08 | 10.08 |

| 28/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.08 | 10.08 | 10.08 |

| 27/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.07 | 10.07 | 10.07 |

| 26/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.07 | 10.07 | 10.07 |

| 23/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.07 | 10.07 | 10.07 |

| 22/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.07 | 10.07 | 10.07 |

| 21/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.07 | 10.07 | 10.07 |

| 20/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.06 | 10.06 | 10.06 |

| 19/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.06 | 10.06 | 10.06 |

| 16/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.06 | 10.06 | 10.06 |

| 15/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.06 | 10.06 | 10.06 |

| 14/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.06 | 10.06 | 10.06 |

| 13/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.05 | 10.05 | 10.05 |

| 12/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.05 | 10.05 | 10.05 |

| 09/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.05 | 10.05 | 10.05 |

| 08/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.05 | 10.05 | 10.05 |

| 07/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.05 | 10.05 | 10.05 |

| 06/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.04 | 10.04 | 10.04 |

| 05/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.04 | 10.04 | 10.04 |

| 02/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.04 | 10.04 | 10.04 |

| 01/11/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.04 | 10.04 | 10.04 |

| 31/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.04 | 10.04 | 10.04 |

| 30/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.04 | 10.04 | 10.04 |

| 29/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.03 | 10.03 | 10.03 |

| 26/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.03 | 10.03 | 10.03 |

| 25/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.03 | 10.03 | 10.03 |

| 23/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.03 | 10.03 | 10.03 |

| 22/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.03 | 10.03 | 10.03 |

| 19/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.02 | 10.02 | 10.02 |

| 18/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.02 | 10.02 | 10.02 |

| 17/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.02 | 10.02 | 10.02 |

| 16/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.02 | 10.02 | 10.02 |

| 15/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.02 | 10.02 | 10.02 |

| 12/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.02 | 10.02 | 10.02 |

| 11/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.02 | 10.02 | 10.02 |

| 10/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.02 | 10.02 | 10.02 |

| 09/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.02 | 10.02 | 10.02 |

| 08/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.02 | 10.02 | 10.02 |

| 05/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.01 | 10.01 | 10.01 |

| 04/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.01 | 10.01 | 10.01 |

| 03/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.01 | 10.01 | 10.01 |

| 02/10/2023 | Green Delta Dragon Enhanced Blue chip Growth Fund ( GDDEBCGF) | 10.01 | 10.01 | 10.01 |

Fund Documents

Application Form to

Purchase Units Individual

Application Form to

Purchase Units Institution

Application Form to

Sale of Units

Application Form to

Transfer Units

Application Form

SIP with Auto Debit Instruction

Date

Download

Date

Download

Date

Download

- Nothing To Download

Date

Download

- Nothing To Download

Date

Download

- Nothing To Download

Date

Download

Date

Download

| Year | Annual Dividend |

| 2020 | 23% |

| 2021 | 3.5% |

| 2023 | 15% |

Prospectus

Fund Teaser

Mutual Funds, Including Green Delta Dragon Enhanced Blue Chip Growth Fund, Do Not Guarantee Performance Or The Preservation of Capital Invested By Investors.