PRODUCTS TO offer

PRODUCTS TO offer

Green Delta Dragon has a team of experts with extensive experience, ample understanding of the market, technical competency and high adaptability, making it well-equipped for managing portfolio investments in this fast-changing world. Utilizing investment instruments such as- Listed Equity Securities, Corporate Bonds and Government Securities, Green Delta Dragon composes tailored solutions for its clients based on their return expectations, risk appetite, liquidity needs and organizational goals.

Clients may choose from the following investment options:

Growth Investment

Investment is made in companies that have unique growth stories with good fundamentals and future earnings profiles such as –

- How much is the company able to earn on new projects?

- How much of the earnings of the company is reinvested in the business?

Large-Cap Investment

Investment is made in cash cow companies with strong fundamentals and history of high dividend yields.

Focus is given on business quality and value creation.

Typically, positions are increased gradually and a large position is taken only when the stock price is undervalued and bottomed-out.

Stable-Income Investment

Investment typically comprised of money market instruments such as Government Securities (G-Sec), Corporate Bonds and IPO investments of potential future market leaders.

This product offers stable income with low variability of return (minimum risk) and maintains high liquidity with low tax burden.

Mostly suited for Provident and Gratuity Funds.

THE SERVICE TAKERS

THE SERVICE TAKERS

Institutional Portfolio Management

Banks, NBFIs & Insurances :

Commercial Banks, Non-Bank Financial Institutions and Insurance Companies can invest in equity securities as a part of their treasury management activities, based on their liquidity needs, return expectations and long-term organizational goal.

Banks, NBFIs & Insurances :

Commercial Banks, Non-Bank Financial Institutions and Insurance Companies can invest in equity securities as a part of their treasury management activities, based on their liquidity needs, return expectations and long-term organizational goal.

Provident & Gratuity Funds :

Financial Institutions, Multinational Companies and Local Corporates having a large pool of Provident and Gratuity Funds with long investment cycles are perfectly suited for the “Stable-Income Investment” solution.

Provident & Gratuity Funds :

Financial Institutions, Multinational Companies and Local Corporates having a large pool of Provident and Gratuity Funds with long investment cycles are perfectly suited for the “Stable-Income Investment” solution.

Corporates and Institutions :

Large Corporates and Institutions having significant amounts of liquid cash on hand are perfectly suited for investing in equity and money market securities, as these investment instruments are highly liquid in nature.

Corporates and Institutions :

Large Corporates and Institutions having significant amounts of liquid cash on hand are perfectly suited for investing in equity and money market securities, as these investment instruments are highly liquid in nature.

TAILORED PORFTOLIO CONSTRUCTION

TAILORED PORFTOLIO CONSTRUCTION

INSTITUTIONAL PORTFOLIO MANAGEMENT approach

INSTITUTIONAL PORTFOLIO MANAGEMENT approach

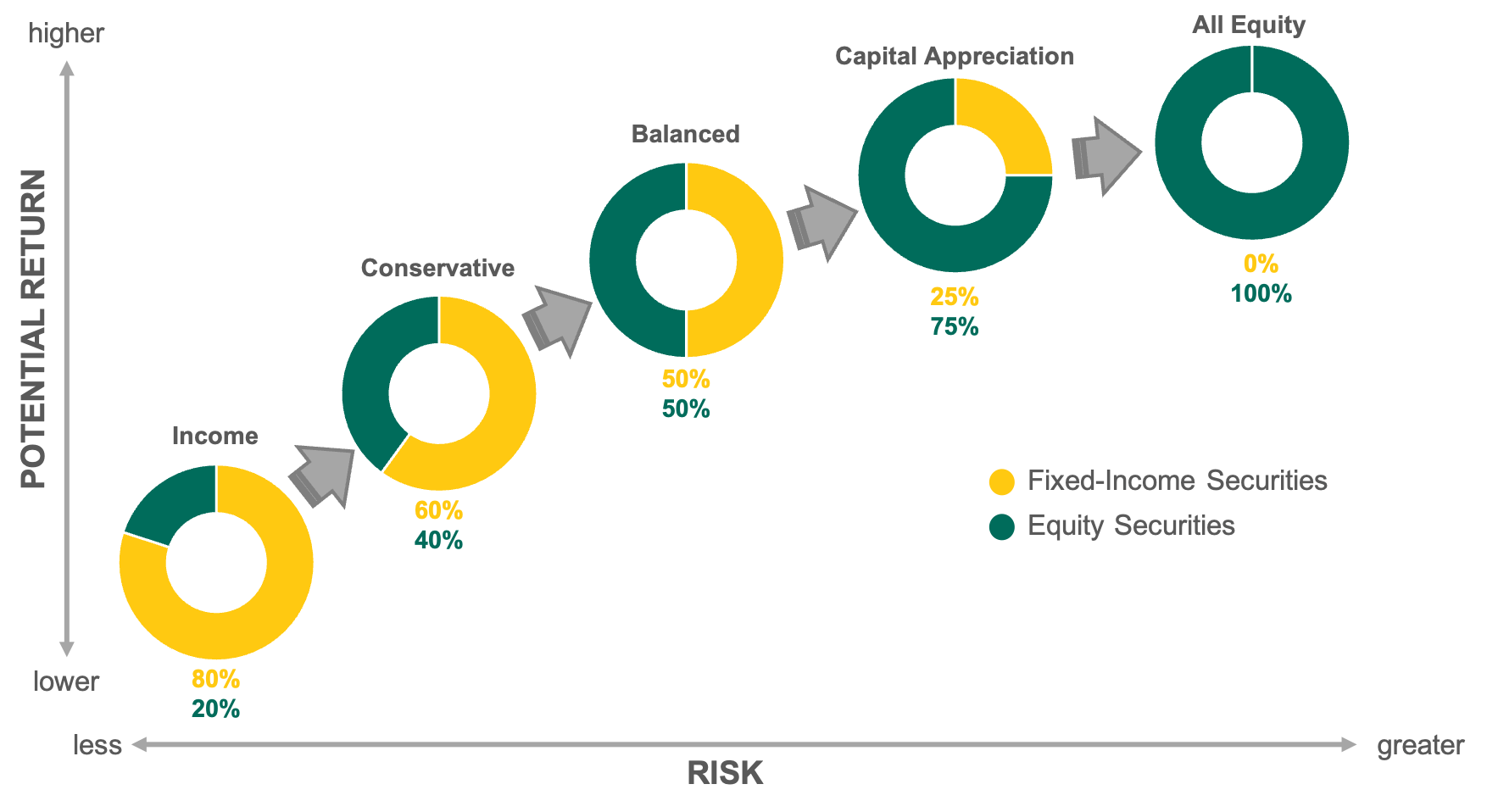

Green Delta Dragon formulates tailored investment solutions for clients according to their return expectations, risk appetite and time horizon for investment.

Backed by a full-fledged investment research team that provides timely investment recommendations supported by thorough economic and capital market analysis.

Portfolio managers incorporate extensive market insights and sound technical knowledge while constructing and managing portfolios.

Formal oversight of the investment process, guidelines and policy restrictions are governed by the Investment Committee.

Our Investmwnt & Fee Structure

Our Investmwnt & Fee Structure

Investment Structure

- Investment Size: As per client’s preference

- Performance Reporting: Quarterly

- Fees: As per Investment Management Agreement (IMA). Besides, client shall have the discretion to choose between a “Management Fee Only” or a “Performance Fee with Hurdle Rate” structure.

- Deposit/Withdrawal: As per Investment Management Agreement (IMA)

| Asset Under Management (AUM) | Management Fee for Equity Portfolio | Management Fee for Fixed-income Portfolio |

| Minimum of BDT 1 million | 1.00% | 0.75% |

| Other Fees | As per IMA | As per IMA |

| Terms for Equity Portfolio | Terms for Equity Portfolio | |

| Client AUM | Minimum of BDT 1 million | Minimum of BDT 1 million |

| Hurdle Rate (yearly) | 10% for Equity Portfolio | Latest average of 6-months FD rate**+ 0.50% |

| Performance Fee | 20% of Profits above Hurdle Rate | 20% of Profits above Hurdle Rate |

| High-Watermark | Yes | Yes |

Typical Investment Lifecycle

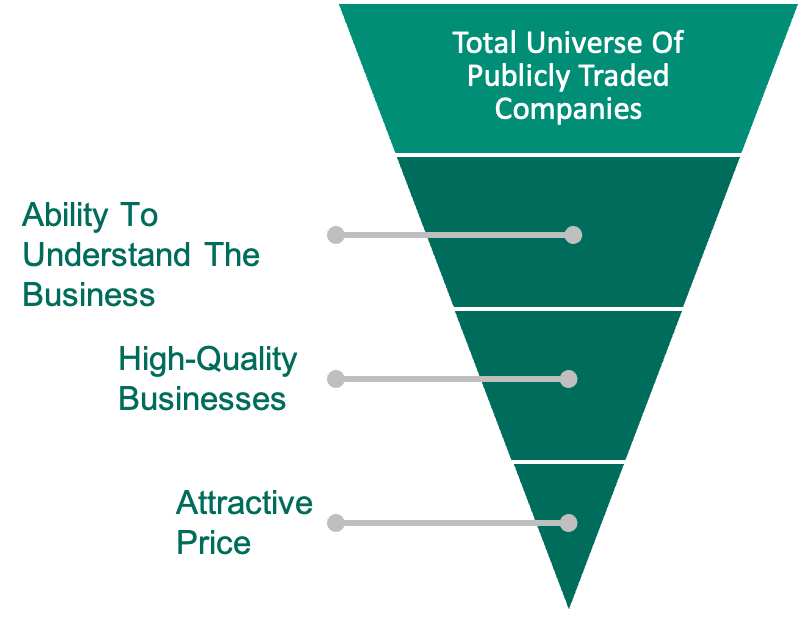

Our success depends on exercising patience and discipline to invest only in situations that meet our criteria:

Typical Investment Lifecycle

Our success depends on exercising patience and discipline to invest only in situations that meet our criteria:

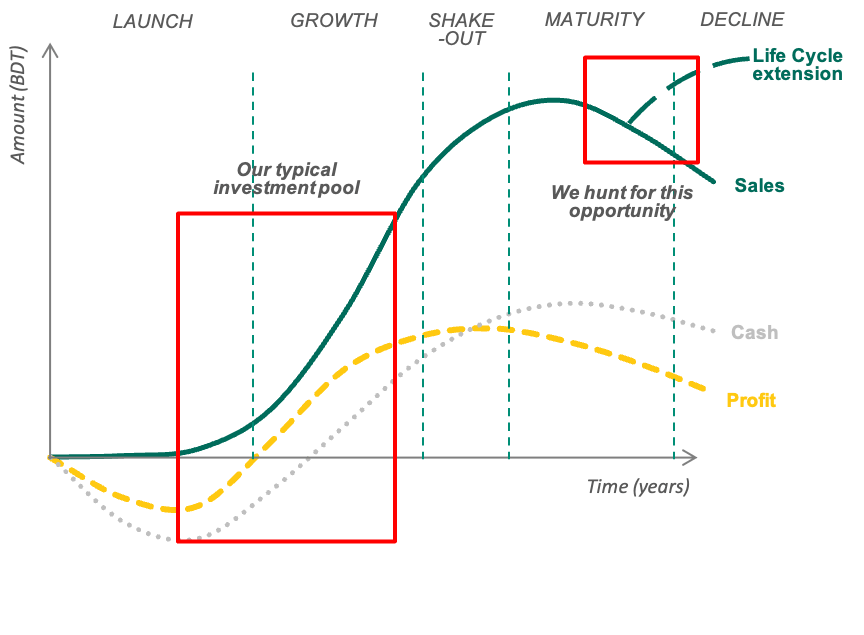

Typical Investment Pool

Investment company life-stage, as illustrated by the S-Curve

TAX Benefit of Investing in The Stock Market

TAX Benefit of Investing in The Stock Market

Investment in stock market through GDDA to reduce income tax burden by availing investment tax rebate and reinvesting a higher proportion of investee pay-outs.

| TAX IMPACT ON STOCK INVESTMENT | ||

| Taxation on Dividend Income | Taxation on Capital Gain | |

| Local Corporate | 20% | 10% |

| Foreign Corporate | 30% | 15% |

*Ref: Clause 22(A) of Schedule 6, Part A read with section 44(1) of the Income Tax Ordinance 1984; SRO no-196-Rule/Incometax/205 DATED 30th June 2015

Note: AIT= Advance Income Tax