What is SIP?

What is SIP?

Systematic Investment Plan (SIP) is an investment mode with which an investor can invest in a mutual fund through installments at regular intervals, typically monthly. This systematic approach helps investors benefit from money cost averaging and the power of compounding over time.

Why invest in GDD EBCGF SIP?

Why invest in GDD EBCGF SIP?

Experienced investors understand that any economy goes through ups and downs, and investing in the stock market can be unpredictable. However, they also see that in the long run, any emerging and frontier markets’ economy, like that of Bangladesh’s, looks promising. Hence by investing in the stock market of such economies, an investor can achieve great returns.

SIPs provide a strategic and disciplined approach to navigate the uncertainties of the stock market. By consistently investing fixed amounts at regular intervals, investors can take advantage of market fluctuations, particularly in emerging economies.

Green Delta Dragon Enhanced Blue Chip Growth Fund (GDD EBCGF) provides SIP to meet investors’ goal of superior returns. To reach this goal, GDD EBCGF uses research to decide how to invest money, including, but not limited to assessment of-

Macro-economic indicators and socio-economic conditions.

Market trends, liquidity, and interest rates.

Sectoral outlook, business cycle analysis, regulatory events.

Investee Company and Group fundamentals, management quality, financial profile.

ESG considerations within the sector and for Investee Company/ Group.

Research for latent value potential.

Adherence to GDD EBCGF Investment Policy and Restrictions.

Diversification safeguards by industry and Investee profiles.

Benefits of SIP-

Benefits of SIP-

Power of Compounding :

SIPs leverage the power of compounding as reinvested returns contribute to additional earnings, fostering exponential wealth growth over time.

Power of Compounding :

SIPs leverage the power of compounding as reinvested returns contribute to additional earnings, fostering exponential wealth growth over time.

Cost Averaging :

SIP investors receive fewer units when mutual fund unit prices rise and more units when prices fall, resulting in an averaged purchase price over time.

Cost Averaging :

SIP investors receive fewer units when mutual fund unit prices rise and more units when prices fall, resulting in an averaged purchase price over time.

Tax Benefits :

An SIP investor is eligible for all the tax benefits that a retail investor of a mutual fund is entitled to.

Tax Benefits :

An SIP investor is eligible for all the tax benefits that a retail investor of a mutual fund is entitled to.

Flexible Investment Plan :

SIP automates savings for salaried individuals, offering convenient access to professional fund management through regular, flexible investments.

Flexible Investment Plan :

SIP automates savings for salaried individuals, offering convenient access to professional fund management through regular, flexible investments.

Liquidity :

SIP offers liquidity as investors can sell mutual fund units at any time, providing flexibility in accessing funds.

Flexible Investment Plan :

SIP automates savings for salaried individuals, offering convenient access to professional fund management through regular, flexible investments.

Who should invest in SIP?

Who should invest in SIP?

Any individual or institution can invest in SIP. However, investors with limited capital market knowledge should consult with their financial advisors before investing in SIP, Minor (<18 years old) or persons of unsound mind are ineligible to invest in SIP.

SIPs provide an accessible and straightforward entry point for individuals new to investing. The consistent and smaller investment amounts remove the pressure of timing the market, making it a less daunting option for beginners.

Investors appreciating the concept of consistently investing over time may find SIPs appealing. Through a fixed amount at regular intervals, they automatically buy more units when prices are lower and fewer units when prices are higher, mitigating the impact of market volatility.

SIP investors should be comfortable with market fluctuations. Given the regular investment nature of SIPs, investors are exposed to various market conditions. Therefore, having a tolerance for short-term market changes is essential.

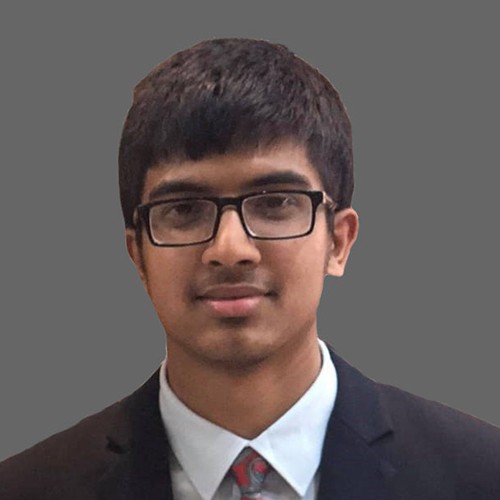

Steps to invest in SIP-

Steps to invest in SIP-

FAQs regarding SIP-

FAQs regarding SIP-

A Systematic Investment Plan (SIP) is a disciplined investment strategy where an investor regularly contributes a fixed amount of money at predetermined intervals (usually monthly) into a mutual fund or other investment avenues.

SIP involves investing a fixed amount regularly, regardless of market conditions. This approach allows investors to buy more units when prices are low and fewer units when prices are high, averaging the cost of investment over time.

The minimum investment amount for SIP is BDT 1,000 and can be raised to multiples of BDT 1,000.

A Systematic Investment Plan (SIP) is like a monthly savings plan for mutual funds, helping you invest a fixed amount regularly to reduce the impact of market changes. On the other hand, a Deposit Pension Scheme (DPS) is a monthly savings account where you deposit money for a set period, and when it matures, you get an agreed amount. If you need to stop, with DPS, you might get your money back with little or no interest, while with SIP, there’s a small 1% exit load if you sell your investment before minimum tenure

SIPs are typically recommended for long-term goals due to the compounding effect. While they can be used for short-term goals, investors should carefully choose funds aligned with their time horizon and risk tolerance.

An SIP investor is eligible for all the tax benefits that a retail investor of a mutual fund is entitled to.

Yes, investors can stop or pause their SIPs at any time. However, if investors want to stop their SIPs before minimum tenure, a 1% exit load will be applicable.

In a lump-sum investment, an investor puts a significant amount of money into the market at once. SIP, on the other hand, involves regular, smaller investments over time. SIP provides the benefit of cost averaging and minimizes the impact of market volatility.

No, SIP returns are subject to market fluctuations. They depend on the performance of the underlying investments in the chosen mutual fund. Past performance is not indicative of future results.