As part of its product diversification, the Dhaka Stock Exchange (DSE) has planned to launch an exchange-traded fund (ETF) by September this year.

LankaBangla Asset Management, Shanta Asset Management, and Green Delta Dragon Asset Management have recently shown their interest in becoming a sponsor of an ETF, and already submitted proposals to this end.

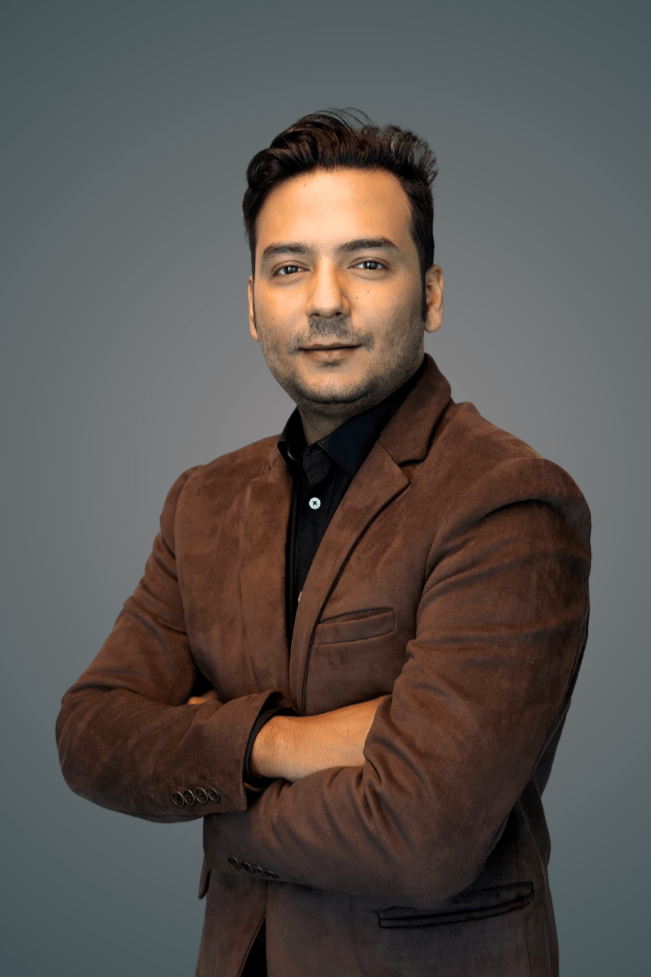

The DSE will also launch an alternative trading board (ATB) with some companies in unlisted securities, mutual funds and over the counter market, said Tarique Amin Bhuiyan, managing director of the country’s premier bourse, at a press conference on Tuesday.

Currently, alongside equities, bonds, Sukuk and mutual funds are traded at the country’s capital market.

An exchange-traded fund is a type of pooled investment security that operates like a mutual fund.

Typically, ETFs will track a particular index, commodity or other assets, but unlike mutual funds, ETFs can be purchased or sold on a stock exchange the same way a regular stock is traded.

“ETFs will be passive in nature and they will reduce the market volatility and direct participation of the retail investors in the capital market,” Tarique Amin Bhuiyan said at the press conference held at the DSE Tower in Nikunja.

“More institutional participation will be increased and the market will be in a stable stage,” he added.

The Dhaka bourse’s managing director said ETFs have several advantages over traditional open-end funds. The four most prominent advantages are trading flexibility, portfolio diversification and risk management, lower costs, and tax benefits.

He said an ETF is a product similar to a mutual fund, which will be managed by an asset manager. Initially, an ETF will be launched with DSE-30 index companies by setting up a fund of Tk50 crore.

Asset management companies will raise funds like mutual funds, allowing them to invest only in shares of DSE-30 listed companies. But, it cannot buy excessive shares of a company alone but will invest in each company on a weighted average basis.

ETFs will be listed on stock exchanges and will also pay dividends to general investors.

In this regard, the managing director of the DSE said the entrepreneur will invest Tk5 crore at the rate of 10% and the asset manager will invest Tk1 crore at the rate of 2% for the formation of an ETF of Tk50 crore. The remaining Tk44 crore will be raised from general investors in the stock market or through private placements.

Noting that ETFs are much safer than mutual funds, Tarique Amin Bhuiyan said that ETFs are never destroyed. For example, he said, the first ETF would be formed with DSE-30 index companies. Now, if one of the 30 companies exits the DSE-30 index, then the ETF’s asset manager will sell the securities of that company and buy the securities of the company which is new to the 30-index.

He said companies of the over-the-counter market (OTC) would transact at ATB. There will also be unlisted mutual funds and private placement transactions.

At the press conference, DSE Chief Operating Officer (COO) Saifur Rahman Majumder and Chief Technology Officer (CTO) Ziaul Karim were also present.