Exchange-Traded Fund (ETF) will finally be launched in September this year to facilitate diversification of the country’s stock market.

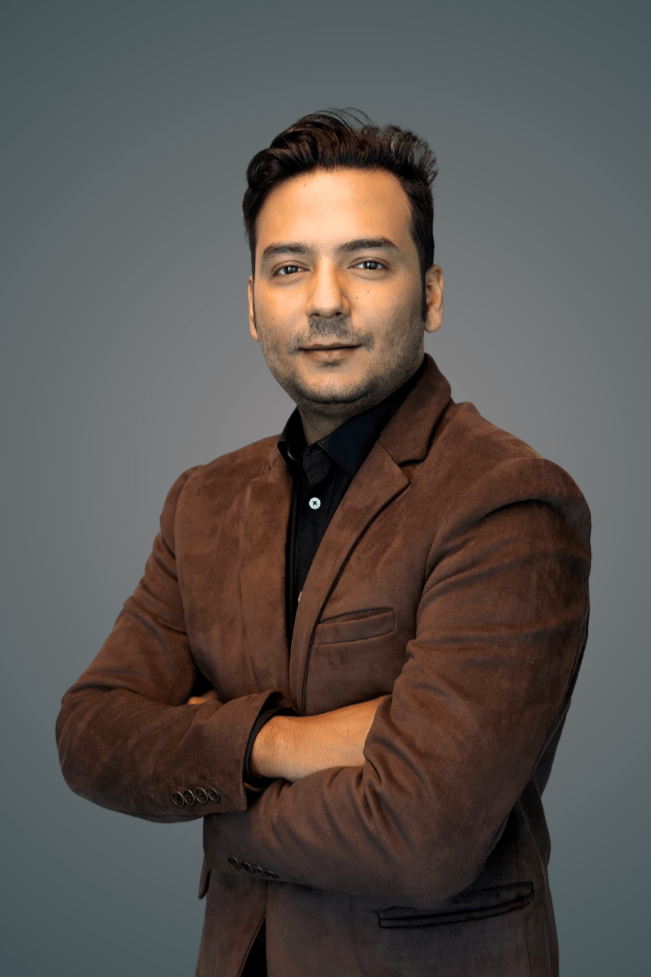

The managing director of Dhaka Stock Exchange (DSE) Tarique Amin Bhuiyan on Tuesday made the announcement at a press briefing held at the DSE office at Nikunja in the city.

“The ETF, a fund like mutual fund, will be floated in September this year. Initially, the fund will be launched with a size of Tk 500 million,” Mr. Bhuiyan said.

An ETF is a collective investment scheme that continuously issues and redeems its shares of stock in creation of unit in exchange for basket and representing an index.

Like the mutual fund, an ETF is operated by asset manager under the supervision of trustee.

To diversify the country’s stock market, the Bangladesh Securities and Exchange Commission (BSEC) finalised the rules of the ETF in early May, 2017 and a gazette on the rules was published on June 13, 2017.

Meanwhile, LankaBangla Asset Management, Shanta Asset Management and Green Delta Dragon Asset Management Company have taken initiatives to float the ETF.

The DSE managing director Mr. Bhuiyan said the ETF worth Tk 500 million will be invested in DS-30 securities only based on their weighted average.

Of Tk 500 million, the sponsor will contribute 10 per cent or Tk 50 million, asset manager 2.0 per cent or Tk 10 million and the remaining 440 million will be collected from general investors or through private placements.

“The first ETF will comprise of the DS-30 companies and investment will be withdrawn from a company if it is excluded from the DS-30 index. And that investment will be transferred to another security included in DS-30 index,” said the DSE managing director Mr. Bhuiyan.

He said in future the ETF will be formed taking into account the companies of different sectors or the companies included in shariah index.

“The exchange’s alternative trading board (ATB) will also be launched within September this year. The companies of over-the-counter (OTC) will be traded there.”

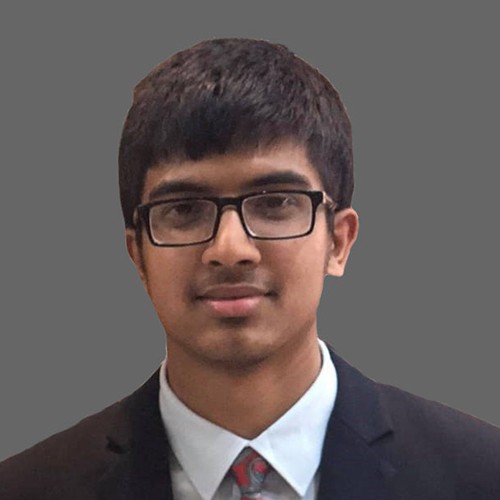

The DSE’s chief operating officer M. Shaifur Rahman Mazumdar said the ETF is treated as an important product of the capital markets across the world.

“The mutual fund sector will also be improved through the introduction of the ETF,” Mr. Mazumdar said.